Get the free promissory note template north carolina form

Show details

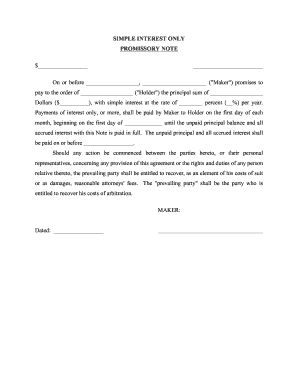

SAMPLE PROMISSORY NOTE $ Principal Amount Dated Any City, New Jersey. In installments as herein stated, for value received, we jointly and severally, promise to pay, Husband and Wife, or order, at

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your promissory note template north form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory note template north form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit promissory note template north carolina online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit promissory note template word north carolina form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out promissory note template north

How to fill out a North Carolina promissory note:

01

Begin by including the date at the top of the document. It is important to accurately record the date of the promissory note.

02

Enter the names and addresses of both the borrower and lender. Include their contact information to ensure clarity and open lines of communication.

03

Specify the principal amount being borrowed. Clearly state the exact amount that will be lent or borrowed. It is crucial to be accurate and precise.

04

Outline the interest rate, if applicable. If there will be an interest rate attached to the loan, clearly state the rate and how it will be calculated.

05

Explain the repayment terms. Include the agreed-upon repayment schedule, such as the frequency and due dates of payments, and specify any penalties for late payments.

06

Include any additional terms and conditions. If there are any special agreements or conditions regarding the loan, such as collateral or prepayment options, make sure to state them clearly.

07

Provide spaces for signatures and dates. Both the borrower and lender should sign and date the promissory note to indicate their agreement to its terms.

Who needs a North Carolina promissory note:

01

Individuals or businesses lending money: If you are lending money to someone, having a promissory note can help protect your interests and ensure that the borrower repays the loan.

02

Individuals or businesses borrowing money: If you are borrowing money, a promissory note can help establish the terms and conditions of the loan, protecting both you and the lender.

03

Legal professionals: Lawyers, attorneys, and legal professionals who deal with loan transactions may need to prepare or review promissory notes for their clients. They ensure that the note complies with North Carolina laws and adequately protects their clients' interests.

Fill form nlrb 4701 : Try Risk Free

People Also Ask about promissory note template north carolina

How do I write a simple promissory note?

How do I write a promissory note in Canada?

Will a promissory note hold up in court?

Can I write my own promissory note?

What voids a promissory note?

How long is a promissory note valid in North Carolina?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is north carolina promissory note?

A promissory note is a legal document that outlines the terms and conditions of a loan agreement. In the case of North Carolina, a North Carolina promissory note refers to a promissory note document that adheres to the specific laws and regulations of the state of North Carolina. These laws and regulations may include requirements regarding the content of the promissory note, such as the names of the parties involved, the loan amount, the repayment terms, and any applicable interest rates. It is important to consult with a legal professional or attorney when creating or signing a promissory note to ensure compliance with North Carolina state laws.

Who is required to file north carolina promissory note?

In North Carolina, the person or entity lending money and receiving a promissory note is generally responsible for filing the note. This is done through the appropriate county Register of Deeds office. However, it is always advisable to consult with a qualified attorney or financial advisor for accurate and up-to-date information related to specific circumstances.

How to fill out north carolina promissory note?

To fill out a promissory note in North Carolina, follow the steps below:

1. Begin by including the date at the top of the page. This is the date the promissory note is being created.

2. Write the name and address of the borrower on the left side of the document. Include their full legal name, current address, and any additional contact information if required.

3. Write the name and address of the lender on the right side of the document. Include their full legal name, current address, and any additional contact information if required.

4. Write the principal or loan amount at the top of the page, clearly indicating the exact amount being borrowed. Use both numeric figures and spell it out in words to avoid any confusion.

5. Specify the interest rate that both parties have agreed upon. Clearly state whether it is a fixed rate or variable rate.

6. Include the terms of repayment, such as the duration of the loan and the frequency of payments. For example, specify if the repayments are to be made monthly, quarterly, or annually.

7. If there are any penalties for late payments or defaults, include them in the promissory note. Clearly state the consequences for not repaying the loan on time.

8. Add any additional terms or conditions agreed upon by both parties. This may include provisions for prepayment options, collateral, or any special arrangements specific to the loan.

9. Have both the borrower and lender date and sign the promissory note at the bottom of the document. This ensures that both parties acknowledge and agree to all the terms stated.

10. Consider having the promissory note notarized to add an additional layer of legal authenticity, although it is not legally required in North Carolina.

Remember, it is recommended to consult with a legal professional experienced in North Carolina law to ensure compliance and validation of the promissory note.

What is the purpose of north carolina promissory note?

The purpose of a North Carolina promissory note is to document a legal agreement between a lender and borrower regarding the repayment of a loan. It outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any additional terms agreed upon by both parties. The promissory note serves as legal evidence of the loan and the borrower's commitment to repay the debt.

What information must be reported on north carolina promissory note?

When creating a promissory note in North Carolina, the following information should typically be included:

1. Full names and addresses of both the borrower (also known as the maker) and the lender.

2. Date of the promissory note's creation.

3. Loan amount: The principal sum being borrowed by the borrower from the lender.

4. Interest rate: The annual interest rate that will be charged on the loan.

5. Repayment terms: The specific terms of the loan, including the schedule and frequency of payments, and the total length of the repayment period.

6. Late payment penalties: If applicable, the consequences or penalties for late or missed payments.

7. Collateral or security: Any assets or property pledged as collateral to secure the loan.

8. Default and acceleration clauses: The conditions under which the loan could fall into default and become due in its entirety.

9. Governing law: Identifying that the promissory note is governed by the laws of North Carolina.

10. Signatures: Both the borrower and the lender must sign the promissory note to make it legally binding.

It's important to note that while this information is commonly included, it's recommended to consult with a legal professional or attorney to ensure compliance with North Carolina laws and to address any specific circumstances or requirements.

What is the penalty for the late filing of north carolina promissory note?

I'm not a legal expert, but I can provide some general information. There does not appear to be a specific penalty outlined in North Carolina statutes for the late filing of a promissory note. However, it's important to note that the consequences of late filing may depend on the specific circumstances, contractual agreements, and potential legal action taken by the parties involved. It is recommended to consult with a legal professional or financial advisor for accurate and specific advice regarding the late filing of a promissory note in North Carolina.

Can I sign the promissory note template north carolina electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your promissory note template word north carolina form and you'll be done in minutes.

How do I edit promissory note template nc straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing promissory note north carolina.

How do I edit nc promissory note form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign north carolina promissory note form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your promissory note template north online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Note Template Nc is not the form you're looking for?Search for another form here.

Keywords relevant to north carolina secured promissory note form

Related to promissory note nc

If you believe that this page should be taken down, please follow our DMCA take down process

here

.